Property Tax Relief, Keeping Violent Criminals Behind Bars, Tarrant County Days at the Capitol and more!

February 15, 2025The work of your Texas State Senate is in full swing, with important action this week on providing property tax relief as well as progress on reforming a broken bail system that has allowed violent criminals to get out of jail and harm our citizens. Lots of folks from SD 10 were in Austin this week as Monday and Tuesday were Tarrant County Days at the Capitol. I hope you will take a few minutes to review my latest update, and of course you can always email me with your feedback at [email protected].

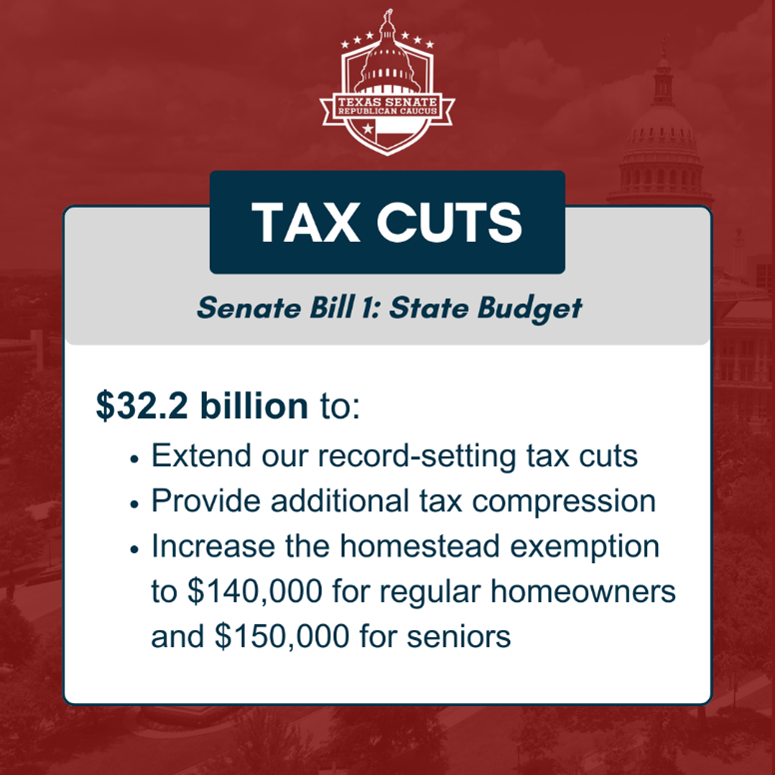

Texas Senate Passes Additional Historic Property Tax Relief

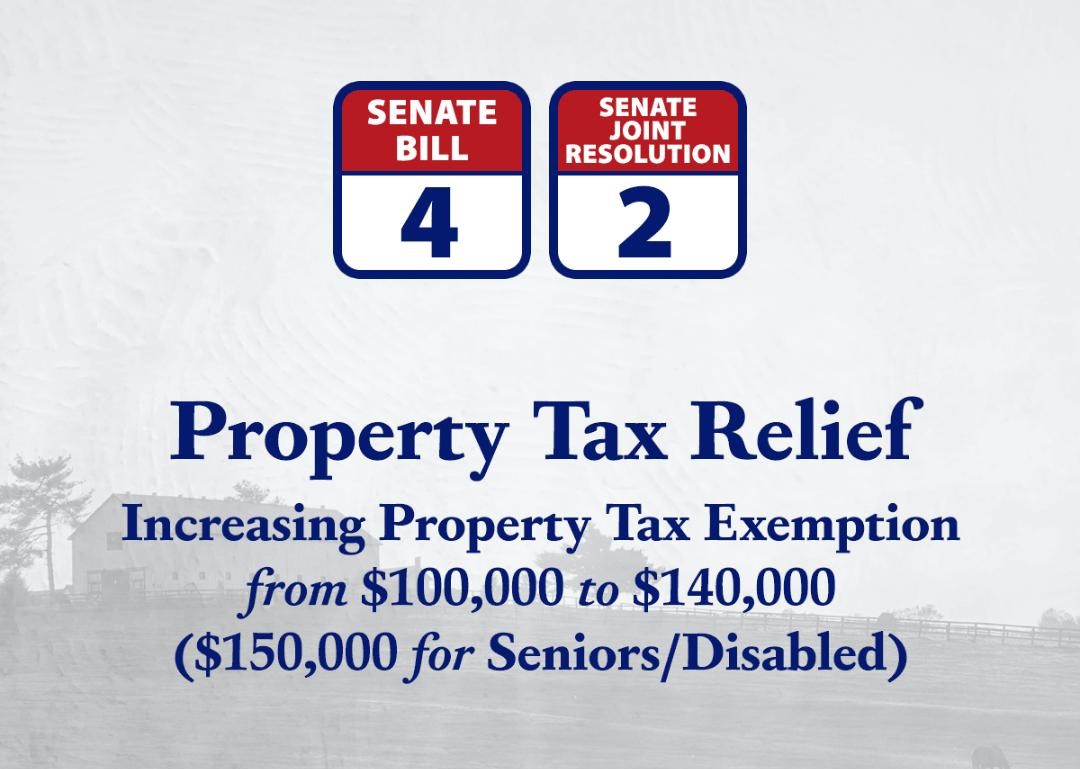

With Texas enjoying another budget surplus, I believe we must return those funds to the taxpayers. On Thursday, the Texas Senate voted out priority property tax relief legislation, SB 4 and SJR 2. This legislation would raise the current property tax exemption from $100,000 to $140,000. The exemption would be $150,000 for seniors over 65 and the disabled.

SB 4/SJR 2 must next pass the Texas House (SB 4 is the enabling legislation for SJR 2). Then, voters would need to approve this measure in a statewide constitutional election, just as prior increases to the homestead exemption have gone before the voters. Amending the constitution makes it much harder for these exemptions to ever be rolled back in the future, because passing an SJR in Texas requires a two-thirds supermajority in the House and Senate, not just a simple majority. Also, Texas voters have made clear in these elections they support these increased exemptions. Included in SB 4 is a “hold harmless” to school districts – the state will make up any formula funding deficit a school district might incur as a result of this exemption increase.

In addition to using the surplus to increase the property tax exemption, the proposed Texas budget continues what is known as “property tax compression.” Remember not too many years ago the M&O (maintenance and operation) portion of your school property tax bill was $1.50 per $100 valuation. For several sessions now, the Legislature has been using the surplus to “buy down” the M&O, and in the new budget it will go to .60 per $100 valuation, providing additional relief. Tax compression also provides tax relief to small businesses, not just homeowners.

This action continues an effort which began in 2015, when the residence homestead exemption was increased from $15,000 to $25,000. In 2017, the Legislature passed and voters approved increasing the exemption up to $40,000 per homestead. In the most recent legislature, we asked voters to raise the homestead exemption to $100,000. In 2023, voters overwhelmingly approved this measure with 83% support.

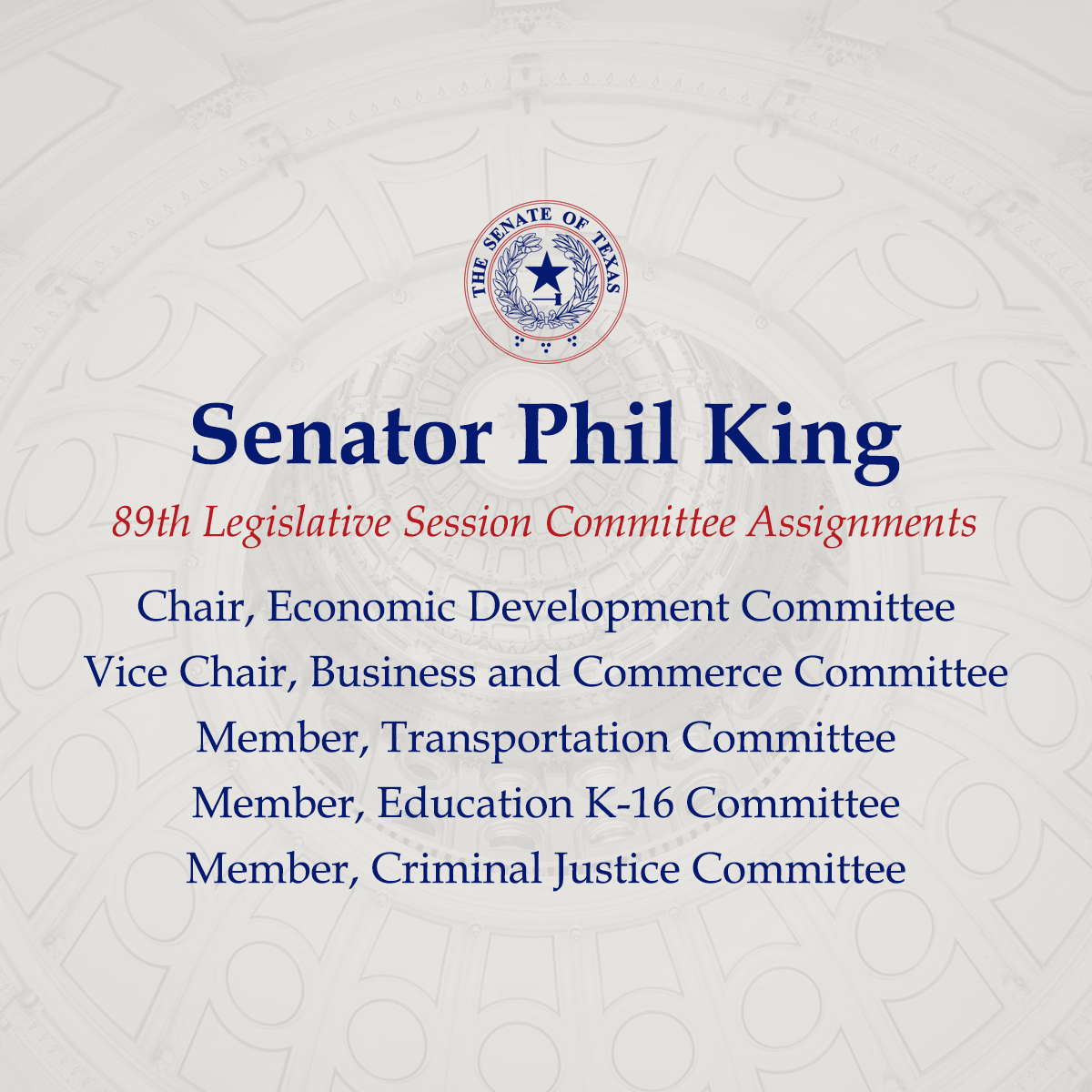

Keeping Dangerous, Violent Criminals Behind Bars: Major Bail Reform Voted Out of Committee

During my time as a Fort Worth police officer, I would arrest a criminal, book them into jail, and trust that the bail system would work to protect citizens from those who shouldn’t be released. For the most part, the system worked well, as we could usually trust judges to use their discretion properly in making these decisions.

However, the system is now broken, due to the irresponsible and reckless actions of certain liberal judges in recent years. I have not seen this occur in SD 10, where we are blessed with many fine judges – many of whom I know personally. Though Harris County and the Greater Houston area are home to some of the most shocking and egregious examples of this judicial abuse, make no mistake – these abuses have impact all across Texas. Far too often, bail is granted to violent criminals who are then released on the streets to terrorize law abiding citizens. Those who are released in one part of Texas can migrate to any county, any community, and inflict their violence again. This is frustrating to law enforcement, as those they apprehend are released in very short order.

This week in the Criminal Justice Committee, I listened to heartbreaking testimony from family members whose relatives were murdered at the hands of those released on bond. One such person was Alexis Nungaray, whose 12-year old daughter Jocelyn was kidnapped, assaulted and strangled last year. Harris County prosecutors say her alleged killers came into the country illegally, and Alexis was forced to appear in court as part of determining bail for her daughter’s killers. Jocelyn’s Mom told us, “I feel outraged that Texas judges are allowed to provide bail for evil people who do heinous things. I feel like it was a slap in the face to Jocelyn and our family to even have to make sure they got an adequate bond, because they preyed on her, on her innocence, and they had no business being here (in the U.S.) in the first place.”

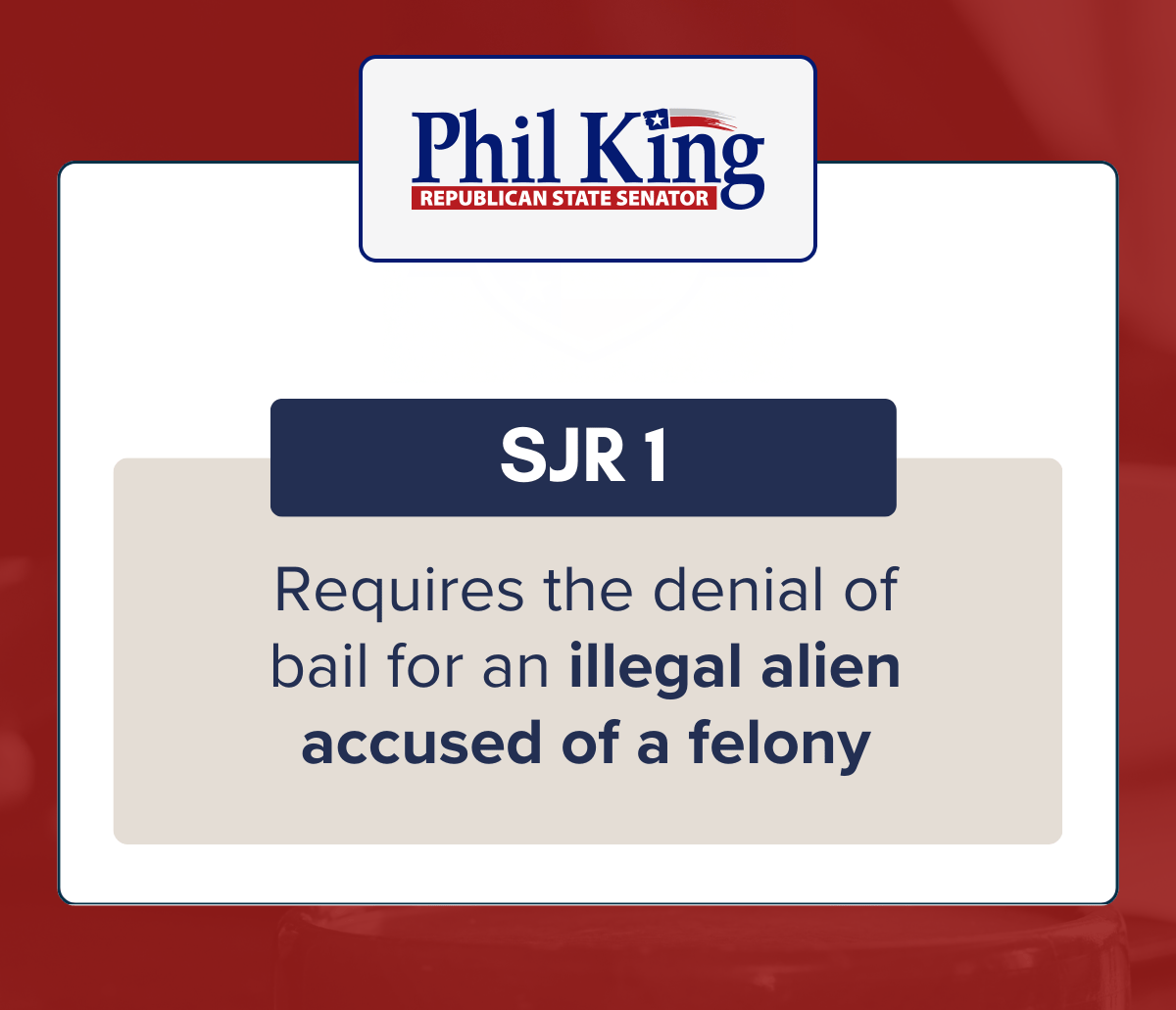

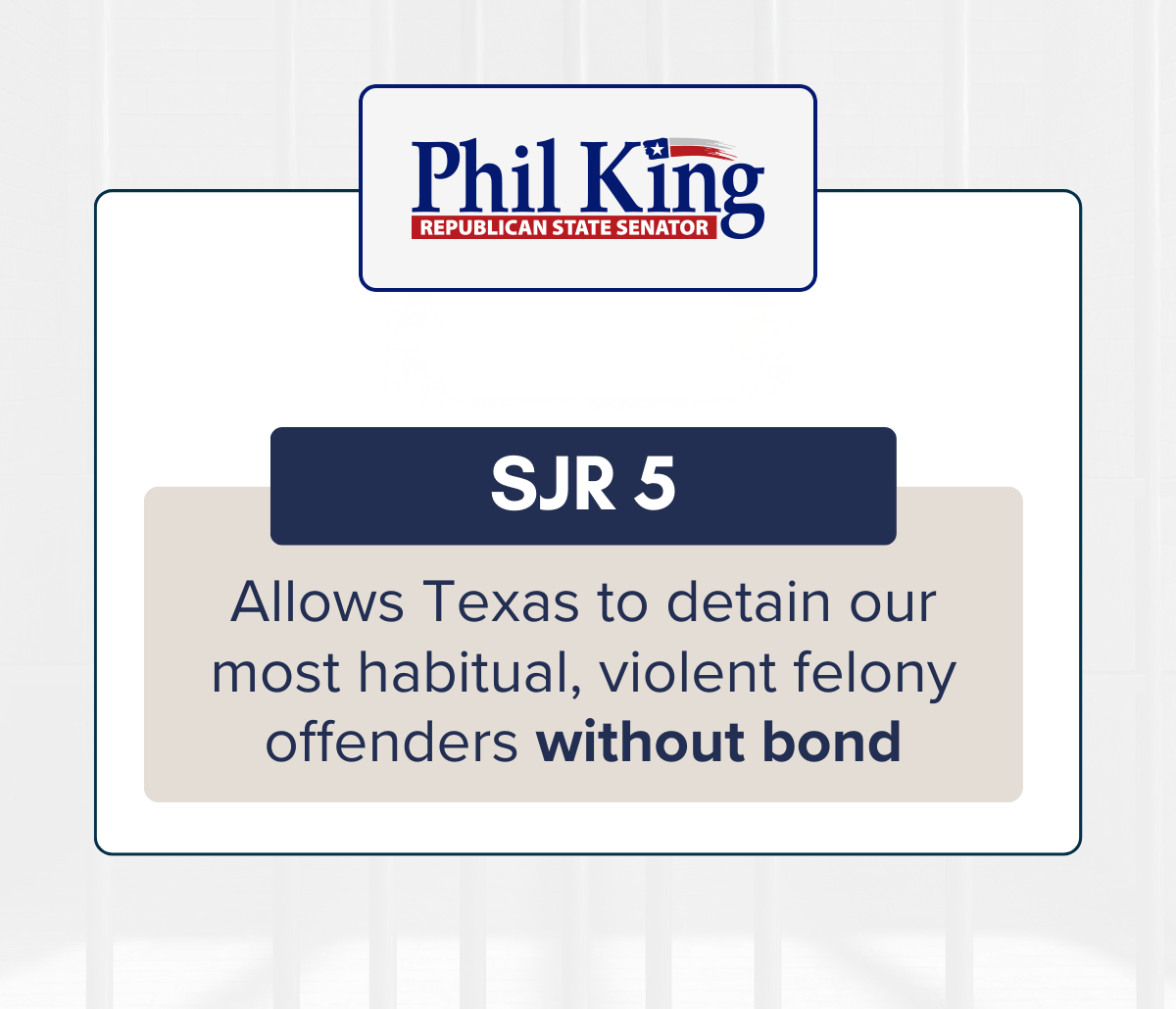

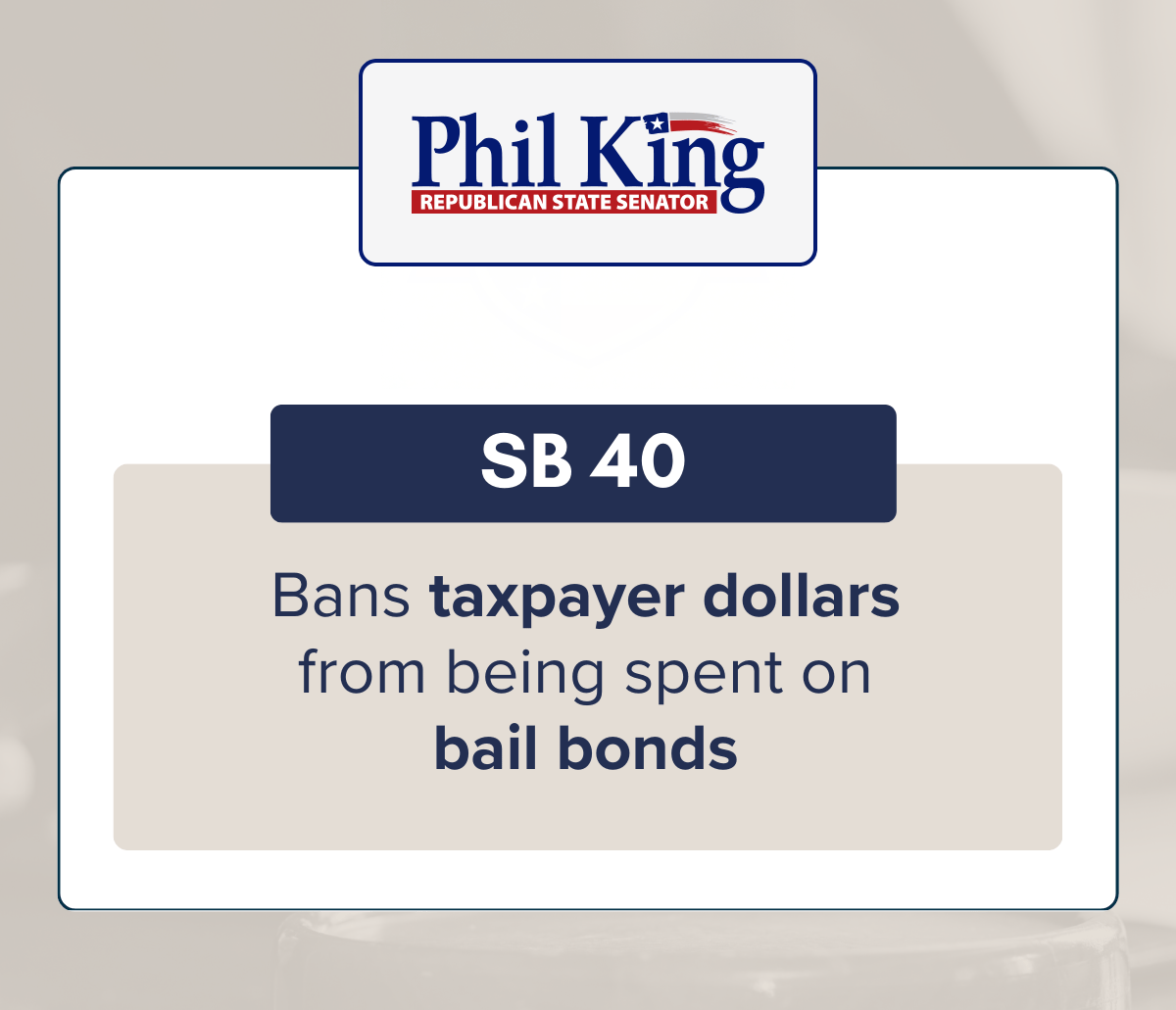

Four bills to correct these injustices and reform the bail system were voted out of the Criminal Justice Committee on which I serve. Lt. Gov. Dan Patrick has named bail reform as one of the Senate’s top legislative priorities, and Gov. Abbott designated bail reform as an emergency item during his State of the State address. These bills now move the full Senate, and here is a summary of what each bill does.

SJR 1 prevents bail for an illegal alien accused of a felony. President Trump recently signed the “Laken Riley Act” to protect against violent offenders that are here illegally, and SJR 1 is the Texas version of this important legislation. SJR 1, to be named “Jocelyn’s Law,” would amend the Texas Constitution to prohibit bail for an undocumented immigrant accused of a felony offense.

Congressman Roger Williams calls on Congress to Reimburse Texas for Border Security

This week, Congressman Roger Williams (TX-25) introduced the Operation Lone Star Reimbursement Act, allowing the State of Texas to be reimbursed for the $11.1 billion we were forced to spend on border security efforts from 2021-2025. I applaud this effort and wish Roger much success. On February 5, Gov. Greg Abbott was in Washington, D.C., meeting with President Donald Trump to discuss border security. In that meeting, the Governor said he asked the President to reimburse Texas for the $11 billion. As you know, because of the failure of the Biden/Harris administration to protect the southern border, we had no choice but to act. We have deployed aircraft, gunboats, DPS troopers, Texas Rangers, the State Guard and National Guard, installed over 5,000 cameras, established the new Texas Task Force on Border & Homeland Security, and invoked the Emergency Management Assistance Compact to work collaboratively with neighboring states. Texas has done far more than any other state to secure our border.

Tarrant County Days at the Texas Capitol

Over 140 people from Tarrant County converged on Austin to make their presence known, meet with elected officials, and enjoy their state capitol. Thanks to everyone who stopped by our office to say hello. It’s an honor to serve Tarrant County, Texas’ largest conservative county.

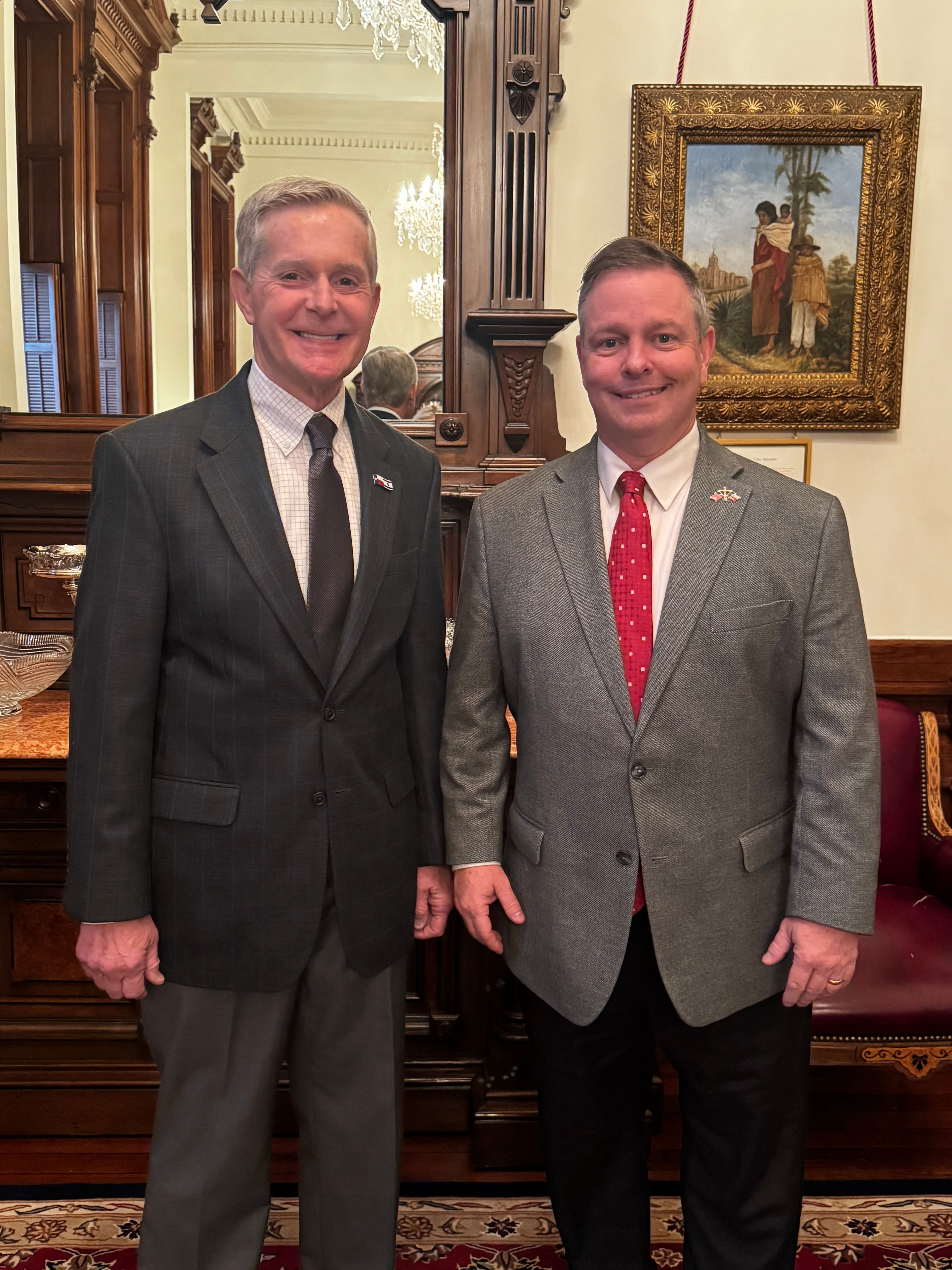

Tarrant County Judge Tim O’Hare joined us on the Senate Floor on Tuesday. Judge O’Hare is doing a great job of increasing government efficiency and keeping Tarrant County a great place to live and work.

On Monday, I met with Fort Worth City Council Members and staff members about their legislative priorities for this session. Fort Worth is rapidly growing – nearing one million residents – thanks to the fantastic leadership from their local government officials, and private partners like the Fort Worth Chamber of Commerce.

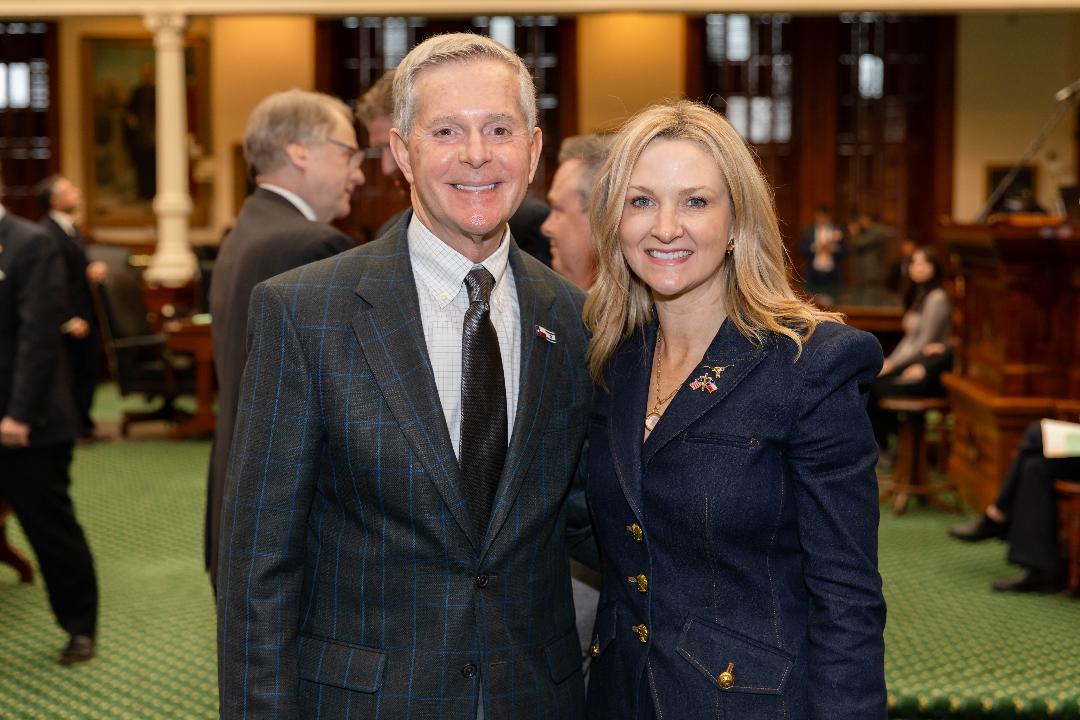

I was honored to give remarks and recognize those gathered in the gallery for Tarrant County Days at the Capitol. Fort Worth Mayor Mattie Parker, Tarrant County Judge Tim O’Hare, and Commissioner Matt Krause joined us on the Senate floor. Mattie was my Chief of Staff many years ago, and I have been proud to watch her serve as Mayor.

On Monday and Tuesday, the Fort Worth Chamber of Commerce and Arlington Chamber of Commerce welcomed business leaders from Tarrant County to the capitol. On Monday, I spoke to the group about our efforts to bolster the electricity grid so we can continue to provide reliable, affordable electricity to all Texans.

With my former Chief of Staff and now Fort Worth Mayor Mattie Parker.